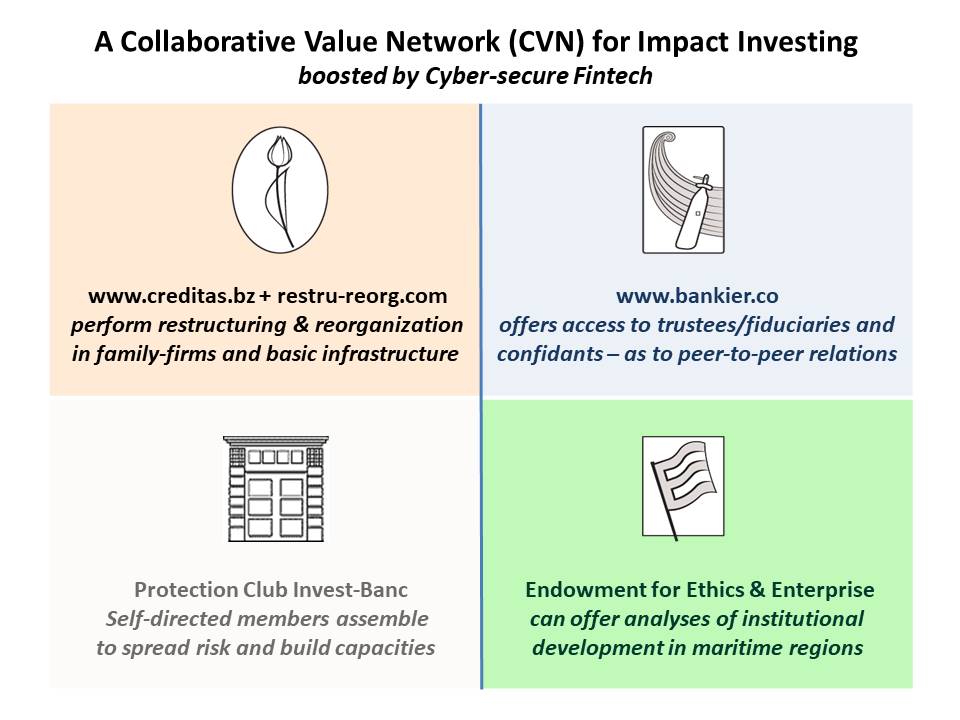

Impact Analyses before-, during- and after any Investment - that is a CRUX of Bankier.co’s CVN-Approach for Impact Investing and Pro-Active Restructuring & Reorganization (PARR)

Needs of owners/enterprisers and investors are similar everywhere – especially in real economies of maritime regions. Academia, co-opting alliances/catalysts and chambers of commerce have shared interests in networking - for example to help repair damaged maritime regions.

Private- and Public Sector can jointly set up an insurance-arrangement to reduce restructuring cost for SMEs - and to stimulate PARR. A fair Debt Relief-reform should require that tax deductions on sale of receivables can only be achieved if the debtor is offered to buy at the same price of a sale to collectors.

A joint Insurance-Arrangement covering partially the cost of PARR - and a Debt Relief-reform - can both offer the Future a better chance.

Cf. Chapter 9 on Debt Relief and Restructuring in S.T.Evensen. 2016. Nordic Model Analyses: Stances on Syndromes vs. Scenarios.

2-two decisive facts:

1) Many Small- and Mid-sized Enterprises (SMEs), hereunder family-owned firms, lack “Names” in media and markets. Why?

Most SMEs are not listed on Stock Exchanges. Therefore, SMEs tend to be underserved by transaction-fee driven incumbents of the financial industry - and they become more exposed to market fluctuations, because e.g. investments in intangible assets are especially hard to value.

2) Impact Analyses and PARR can be applied to prove that participations in SMEs can become viable and/or sustainable, which in turn can make them negotiable.

However, that will require an impartial, parallel "track" to monitor progress; namely, by Enterpriser-Mart(s), where SMEs can broadcast initiatives, needs etc. - as well as publish independent valuations and/or impact analyses verified at arm's length by independent expertise. Cf. more details below.

Independent Impact Analyses (IIA) - a parallel "track" to monitor progress - step by step

All Impact Investing get to a decisive point when- and where viability and sustainability can- and should be proven by Independent Impact Analyses (IIA). Preferably there should be a parallel “track” for analyses before-, during- and after Impact Investing - guided by competent trustees and verified by independent expertise - subject to reporting- and/or transparent broadcasting of an initiative’s progress, its needs, etc. on Enterpriser-Mart(s).

Like everyone else – also SMEs will face sensitive situations, when access to scarce resources are needed, like capital, competent trustees and independent expertise. They can becomr better prepared by choosing to join a Social Enterprise for Impact Investing – organized as a Collaborative Value Network (CVN) – by choosing to participate as Self-directed Capital Partners. Along with others they can assemble strengths-, spread risk- and facilitate access to capital - e.g. for Pro-Active Restructuring & Reorganization (PARR) as well as Mobilizing Regional Knowledge and Capital for Innovation (read: perceived improvement).

SMEs, hereunder family-owned firms, can avoid “Creative Destruction” by General Partners in Vulture Capital Funds - financed by “Other Peoples’ Money (OPM)”.

Indeed, SMEs and/or their owners can become Self-directed Capital Partners of a CVN for Impact Investing. They can make participations in initiatives negotiable on their own accord by helping themselves and other owners/SMEs.

Look to the Page: "Financial Models & Value Creation" – Model E: Social Enterprise for Impact Investing - organized as a Collaborative Value Network (CVN).

PARR and Debt Relief are measures for viable and sustainable reconstruction of SMEs, hereunder family-owned firms - as well as Regional Basic- and Critical Infrastructure.

Qualities of the latter are vital to SMEs.

A steadfast focus on PARR requires Impact- and Institutional Analysis to understand consequences of Green Pricing and changes in access to Resources / Markets / Distribution by simulating alternative strategies of infrastructure by Regional Inter-Modal Transport Analysis (RIMTA).

EU-countries implemented before July 17, 2021 EU Directive 2019-1023 concerning Restructuring, Insolvency, Discharge of Debt. Germany implemented the Directive already on January 1, 2021.

It is similar to US Chapter 11-rules, which can offer a company protection against its creditors for a period of time decided by a competent specialized court. This implies a breakthrough for the efforts of; www.UNCITRAL.org - to harmonize national legislations on pro-active reconstruction (on the one hand) and bankruptcy (on the other hand). That can help reduce losses of resources and human efforts for business owners/enterprisers and investors.

National implementations benefiting also SMEs, hereunder family-owned firms, will require thorough cross-professional preparations and institutional development in order to become effective tools for reconstruction in the wake of COVID-pandemic, warfare and resulting crises.

An era of poor credit extension based on mortgages and other collateral can be over - subject to a fair Reform of Debt Relief.

The EU Action Plan for Sustainable Investments 2022

In November 2019 an EU Regulation on Publishing Information on Sustainability in the Financial Sector was adopted, and most of the requirements in the regulation will apply in the EU from March 10, 2021. It will result in a taxonomy of investments handled by the financial sector, i.e. info must be published on whether investments are sustainalble - or not. Look to the Page: "Financial Reform" for more details.

The CVN-Approach for Impact Investing applies a Role-divided Value Chain organized by a "No-Group-Structure"

It combines a business- and an open ownership model - providing trustee-/fiduciary activities in the fields of owner-/enterpriser dynamics, including PARR, for the benefit of SMEs in Maritime Regions + hinterlands.

Please look to the Page: "The Value Chain of Pro-Active Reconstruction" with a "Pdf" for downloading. It explains:

A CVN-Approach for Impact Investing focuses on uncontested market space(s); namely, needs of owners/enterprisers and investors in SMEs, hereunder family-owned firms.

These needs are similar everywhere - especially in maritime regions - Worldwide. Why? Because most SMEs are not "Names" in media and markets. They tend to be underserved by transaction-fee driven players, who focus on "Names" in financial markets - and their CFOs - for the repeat business of deal flows. Therefore, SMEs lack access to trustees/fiduciaries in fields such as a. o. equity capital-financing, ownership-dilemmas and owner-governance.

Note: A peer-to-peer relation between a SME and a CVN always starts by dialogue to build a Vision and/or a Value Proposition. That's for what an owner/enterpriser - or an investor - needs a competent confidant.

A comparative analysis of a "CVN-Approach for Impact Investing" with a "Private Equity Fund-model"

It reveals that the latter benefits primarily the General Managers, who are performing so-called "Creative Destruction" by applying Other People's Money (OPM).

Look to the Page: "Stances on Private Equity" - on the Barbarian Empire of Private Equity. It refers to a 4-four page article in The Economist October 22, 2016.

For a historic- and systemic perspective look to a book by Louis Brandeis. 1913. Other People's Money: And How the Bankers Use It.

Digitization & Robotics as well as a general Policy on Green Pricing by taxing- and/or stimulating based on actual Use of Resources and Technical Standards

These changes may result in building-down of unsustainable activities in many larger- or mid-sized organizations in both public- and private sector. However, relations, networks and competencies will prevail, if built on trust.

New Regional Basic Infrastructure is much needed - along with New Skills - to avoid mass-unemployment and to create jobs. So-called "Kodak Moments” can be avoided.

OPTIONAL READING – on Bankier.co's history since 1988

The Creditas-Initiative of 2017 was preceded by the Single-Role Invest-Banc Initiative (IBI). Its "lnvestCo" at the time, Bankierhuset AS/Ltd. - later a Plc - was licensed in 1996.

On July 15, 1999 it had to complain to EFTA Surveillance Authority (ESA) in Brussels, because National Remedy had proved impossible. IBI was met with Norwegian Financial Authorities' illegal favoring of the financial industry's incumbents and their financial models (the Multi-Role Financial Group, the Brokerage House for Securities and Fund Management). Their business models are based on cross-selling strategies stimulated by internal bonus schemes, which fail to provide "the best result for the investor/ client"...

From 1996 until 7-2006 the illegal favoring was caused by lacking implementation of the Investor Compensation Scheme Directive (ICSD).

MiFID's investment service definition # 7 is: "Placing of financial instruments without a firm commitment basis"

It is decisive for SMEs without "Names" in media and markets, when access to equity capital and independent competent trustees are concerned. From 11-2007 MiFID's investment service-definition # 6 was implemented correctly. It implied "underwriting" for those with "Names" in financial markets - and it happened on November 1, 2007.

Therefore, Bankier.co had to complain again to ESA in Brussels that investment service definition # 7 was missing - by opening Dossier number 2 of the ESA-Complaint on November 5, 2007.

MiFID's investment service definition # 5: "Investment Advice" should have become an impartial activity after the Financial crisis of 2008.

But, except for in UK, "Investment Advice" did not become a service paid for by the customer. Instead, "Investment Advice" served as marketing of brokers and fund managers' products.

While awaiting a correct implementation of MiFID # 7 Bankier.co had one single license for which customers did not expect to pay; namely, "Investment Advice".

And to top this unfortunate fact - the Norwegian financial industry decided to develop its own profession of so-called "Authorized Financial Advisors". A large number of employees became "advisors" after a crash-course. They got slightly higher wages and started cross-selling products and services - stimulated by internal bonuses. Sic!

On August 12, 2015 after awaiting a correct implementation of investment service definition # 7 the Board of Bankier.co was forced to wind up its licensed company - without debt.

Hours before the Board-meeting a Swedish casehandler at ESA in Brussels made a surprise contact with Bankier.co. S.T.Evensen told the casehandler why the licensed company would be winded up* - and the Board's intent to carry on parts of the former Invest-Banc Initiative (IBI) as a Creditas-Initiative promoted by Bankier.co as an Investment House.

The ESA-casehandler confirmed that the winding up would have no negative consequences for Bankier.co's Complaint to ESA since 1999. At the same time he told S.T.Evensen, that several changes in the archive-systems since 1999 made it difficult to handle the Dossiers of Bankier.co's ESA-complaint. The casehandler asked Bankier.co to transfer the files of its Complaint to ESA in Brussels, because of changes in ESA's Filing System. It was done by S.T.Evensen supported by Bankier.co's controller, lawyers and auditors during the Autumn of 2015.

*) The decision to wind up the licensed company was also caused by the fact that the Norwegian FSA did not recognize Bankier.co's intangible investments as valuable assets for further development of IBI.

While awaiting a correct Norwegian implementation of MiFID the intangible investments were reported as a vital part of IBI's Capital Adequacy - as well as the IBI-initiative's efforts to achieve a real financial innovation to the benefit of SMEs. The intangible investments would be written off against future income, if and when Norway finally arrived at a correct implementation of EU's MiFID. What topped the decision to wind up was that the Norwegian FSA-casehandler:

After a costly restructuring 2015-2017 the resulting Creditas-Initiative + Bankier.co was launched by a participation in HBS.edu New Venture Competition (NVC) 2017

Its entry was as a Social Enterprise for Impact Investing - organized as a Collaborative Value Network (CVN).

A Global Industrial Company responded by setting up a Task Force to evaluate the CVN-Approach for Impact Investing and how it could be applied to Impact Investing related to Water/Food/Health beyond the financial economy. A Case for discussion was developed.

Then a Vulture Fund entered the scene with the intent to break up the Global Industrial and its Alliances/Relations. Therefore, cooperation between the representative of the Task Force and Bankier.co came to a halt.

An improved HBS.edu NVC-entry - boosted by FINTECH - was submitted January 15, 2024.

It is an alternative to "Vulture-funds" - e.g. to challenge a "2/20-remuneration-formula", which has tended to benefit primarily the General Partners. Through special provision in the law, that 20% is treated not as regular compensation, but as Carried Interest, entitling it to preferential capital gains tax treatment; i.e. General Partners are taxed as companies - and NOT as private individuals. Look to the Page on: "Funds Management".

For further details on the CVN-Approach for Impact Investing in Maritime Regions look the Page: "A Columbus' Egg", where a solution to the Conundrum of effecitive Impact Investing is explained.

Note: For an introduction to initiating- and/or participating in an innovative Collaborative Value Network (CVN)-Approach - for owners/enterprisers and investors in a maritime region - look to the Page: "Networking in Maritime Regions" , hereunder Optional Reading on Endowment for Ethics & Enterprise (EEE) - and the Page: "Contact Bankier.co".

Needs of owners/enterprisers and investors are similar everywhere – especially in real economies of maritime regions. Academia, co-opting alliances/catalysts and chambers of commerce have shared interests in networking - for example to help repair damaged maritime regions.

Private- and Public Sector can jointly set up an insurance-arrangement to reduce restructuring cost for SMEs - and to stimulate PARR. A fair Debt Relief-reform should require that tax deductions on sale of receivables can only be achieved if the debtor is offered to buy at the same price of a sale to collectors.

A joint Insurance-Arrangement covering partially the cost of PARR - and a Debt Relief-reform - can both offer the Future a better chance.

Cf. Chapter 9 on Debt Relief and Restructuring in S.T.Evensen. 2016. Nordic Model Analyses: Stances on Syndromes vs. Scenarios.

2-two decisive facts:

1) Many Small- and Mid-sized Enterprises (SMEs), hereunder family-owned firms, lack “Names” in media and markets. Why?

Most SMEs are not listed on Stock Exchanges. Therefore, SMEs tend to be underserved by transaction-fee driven incumbents of the financial industry - and they become more exposed to market fluctuations, because e.g. investments in intangible assets are especially hard to value.

2) Impact Analyses and PARR can be applied to prove that participations in SMEs can become viable and/or sustainable, which in turn can make them negotiable.

However, that will require an impartial, parallel "track" to monitor progress; namely, by Enterpriser-Mart(s), where SMEs can broadcast initiatives, needs etc. - as well as publish independent valuations and/or impact analyses verified at arm's length by independent expertise. Cf. more details below.

Independent Impact Analyses (IIA) - a parallel "track" to monitor progress - step by step

All Impact Investing get to a decisive point when- and where viability and sustainability can- and should be proven by Independent Impact Analyses (IIA). Preferably there should be a parallel “track” for analyses before-, during- and after Impact Investing - guided by competent trustees and verified by independent expertise - subject to reporting- and/or transparent broadcasting of an initiative’s progress, its needs, etc. on Enterpriser-Mart(s).

Like everyone else – also SMEs will face sensitive situations, when access to scarce resources are needed, like capital, competent trustees and independent expertise. They can becomr better prepared by choosing to join a Social Enterprise for Impact Investing – organized as a Collaborative Value Network (CVN) – by choosing to participate as Self-directed Capital Partners. Along with others they can assemble strengths-, spread risk- and facilitate access to capital - e.g. for Pro-Active Restructuring & Reorganization (PARR) as well as Mobilizing Regional Knowledge and Capital for Innovation (read: perceived improvement).

SMEs, hereunder family-owned firms, can avoid “Creative Destruction” by General Partners in Vulture Capital Funds - financed by “Other Peoples’ Money (OPM)”.

Indeed, SMEs and/or their owners can become Self-directed Capital Partners of a CVN for Impact Investing. They can make participations in initiatives negotiable on their own accord by helping themselves and other owners/SMEs.

Look to the Page: "Financial Models & Value Creation" – Model E: Social Enterprise for Impact Investing - organized as a Collaborative Value Network (CVN).

PARR and Debt Relief are measures for viable and sustainable reconstruction of SMEs, hereunder family-owned firms - as well as Regional Basic- and Critical Infrastructure.

Qualities of the latter are vital to SMEs.

A steadfast focus on PARR requires Impact- and Institutional Analysis to understand consequences of Green Pricing and changes in access to Resources / Markets / Distribution by simulating alternative strategies of infrastructure by Regional Inter-Modal Transport Analysis (RIMTA).

EU-countries implemented before July 17, 2021 EU Directive 2019-1023 concerning Restructuring, Insolvency, Discharge of Debt. Germany implemented the Directive already on January 1, 2021.

It is similar to US Chapter 11-rules, which can offer a company protection against its creditors for a period of time decided by a competent specialized court. This implies a breakthrough for the efforts of; www.UNCITRAL.org - to harmonize national legislations on pro-active reconstruction (on the one hand) and bankruptcy (on the other hand). That can help reduce losses of resources and human efforts for business owners/enterprisers and investors.

National implementations benefiting also SMEs, hereunder family-owned firms, will require thorough cross-professional preparations and institutional development in order to become effective tools for reconstruction in the wake of COVID-pandemic, warfare and resulting crises.

An era of poor credit extension based on mortgages and other collateral can be over - subject to a fair Reform of Debt Relief.

The EU Action Plan for Sustainable Investments 2022

In November 2019 an EU Regulation on Publishing Information on Sustainability in the Financial Sector was adopted, and most of the requirements in the regulation will apply in the EU from March 10, 2021. It will result in a taxonomy of investments handled by the financial sector, i.e. info must be published on whether investments are sustainalble - or not. Look to the Page: "Financial Reform" for more details.

The CVN-Approach for Impact Investing applies a Role-divided Value Chain organized by a "No-Group-Structure"

It combines a business- and an open ownership model - providing trustee-/fiduciary activities in the fields of owner-/enterpriser dynamics, including PARR, for the benefit of SMEs in Maritime Regions + hinterlands.

Please look to the Page: "The Value Chain of Pro-Active Reconstruction" with a "Pdf" for downloading. It explains:

- Why a New Deal is essential to effective Reconstruction - namely, to reduce bankruptcies and resulting losses of resources and jobs in the wake of pandemic and resulting crises;

- The Urgency of a New Deal and its Strategic Issues;

- A role-divided "No Group Structure" for an Impact Investing.Strategy and a successful Scaling-Up.

A CVN-Approach for Impact Investing focuses on uncontested market space(s); namely, needs of owners/enterprisers and investors in SMEs, hereunder family-owned firms.

These needs are similar everywhere - especially in maritime regions - Worldwide. Why? Because most SMEs are not "Names" in media and markets. They tend to be underserved by transaction-fee driven players, who focus on "Names" in financial markets - and their CFOs - for the repeat business of deal flows. Therefore, SMEs lack access to trustees/fiduciaries in fields such as a. o. equity capital-financing, ownership-dilemmas and owner-governance.

Note: A peer-to-peer relation between a SME and a CVN always starts by dialogue to build a Vision and/or a Value Proposition. That's for what an owner/enterpriser - or an investor - needs a competent confidant.

A comparative analysis of a "CVN-Approach for Impact Investing" with a "Private Equity Fund-model"

It reveals that the latter benefits primarily the General Managers, who are performing so-called "Creative Destruction" by applying Other People's Money (OPM).

Look to the Page: "Stances on Private Equity" - on the Barbarian Empire of Private Equity. It refers to a 4-four page article in The Economist October 22, 2016.

For a historic- and systemic perspective look to a book by Louis Brandeis. 1913. Other People's Money: And How the Bankers Use It.

Digitization & Robotics as well as a general Policy on Green Pricing by taxing- and/or stimulating based on actual Use of Resources and Technical Standards

These changes may result in building-down of unsustainable activities in many larger- or mid-sized organizations in both public- and private sector. However, relations, networks and competencies will prevail, if built on trust.

New Regional Basic Infrastructure is much needed - along with New Skills - to avoid mass-unemployment and to create jobs. So-called "Kodak Moments” can be avoided.

OPTIONAL READING – on Bankier.co's history since 1988

The Creditas-Initiative of 2017 was preceded by the Single-Role Invest-Banc Initiative (IBI). Its "lnvestCo" at the time, Bankierhuset AS/Ltd. - later a Plc - was licensed in 1996.

On July 15, 1999 it had to complain to EFTA Surveillance Authority (ESA) in Brussels, because National Remedy had proved impossible. IBI was met with Norwegian Financial Authorities' illegal favoring of the financial industry's incumbents and their financial models (the Multi-Role Financial Group, the Brokerage House for Securities and Fund Management). Their business models are based on cross-selling strategies stimulated by internal bonus schemes, which fail to provide "the best result for the investor/ client"...

From 1996 until 7-2006 the illegal favoring was caused by lacking implementation of the Investor Compensation Scheme Directive (ICSD).

MiFID's investment service definition # 7 is: "Placing of financial instruments without a firm commitment basis"

It is decisive for SMEs without "Names" in media and markets, when access to equity capital and independent competent trustees are concerned. From 11-2007 MiFID's investment service-definition # 6 was implemented correctly. It implied "underwriting" for those with "Names" in financial markets - and it happened on November 1, 2007.

Therefore, Bankier.co had to complain again to ESA in Brussels that investment service definition # 7 was missing - by opening Dossier number 2 of the ESA-Complaint on November 5, 2007.

MiFID's investment service definition # 5: "Investment Advice" should have become an impartial activity after the Financial crisis of 2008.

But, except for in UK, "Investment Advice" did not become a service paid for by the customer. Instead, "Investment Advice" served as marketing of brokers and fund managers' products.

While awaiting a correct implementation of MiFID # 7 Bankier.co had one single license for which customers did not expect to pay; namely, "Investment Advice".

And to top this unfortunate fact - the Norwegian financial industry decided to develop its own profession of so-called "Authorized Financial Advisors". A large number of employees became "advisors" after a crash-course. They got slightly higher wages and started cross-selling products and services - stimulated by internal bonuses. Sic!

On August 12, 2015 after awaiting a correct implementation of investment service definition # 7 the Board of Bankier.co was forced to wind up its licensed company - without debt.

Hours before the Board-meeting a Swedish casehandler at ESA in Brussels made a surprise contact with Bankier.co. S.T.Evensen told the casehandler why the licensed company would be winded up* - and the Board's intent to carry on parts of the former Invest-Banc Initiative (IBI) as a Creditas-Initiative promoted by Bankier.co as an Investment House.

The ESA-casehandler confirmed that the winding up would have no negative consequences for Bankier.co's Complaint to ESA since 1999. At the same time he told S.T.Evensen, that several changes in the archive-systems since 1999 made it difficult to handle the Dossiers of Bankier.co's ESA-complaint. The casehandler asked Bankier.co to transfer the files of its Complaint to ESA in Brussels, because of changes in ESA's Filing System. It was done by S.T.Evensen supported by Bankier.co's controller, lawyers and auditors during the Autumn of 2015.

*) The decision to wind up the licensed company was also caused by the fact that the Norwegian FSA did not recognize Bankier.co's intangible investments as valuable assets for further development of IBI.

While awaiting a correct Norwegian implementation of MiFID the intangible investments were reported as a vital part of IBI's Capital Adequacy - as well as the IBI-initiative's efforts to achieve a real financial innovation to the benefit of SMEs. The intangible investments would be written off against future income, if and when Norway finally arrived at a correct implementation of EU's MiFID. What topped the decision to wind up was that the Norwegian FSA-casehandler:

- Interpreted incorrectly the required level of equity capital for an investment firm to offer investment service # 7: "Placing of financial instruments without a firm commitment basis";

- Decided unfairly to require only a few days to comply with an incorrect capital adequacy-requirement; namely, at the same level as investment service # 6 for providing "Underwriting".

After a costly restructuring 2015-2017 the resulting Creditas-Initiative + Bankier.co was launched by a participation in HBS.edu New Venture Competition (NVC) 2017

Its entry was as a Social Enterprise for Impact Investing - organized as a Collaborative Value Network (CVN).

A Global Industrial Company responded by setting up a Task Force to evaluate the CVN-Approach for Impact Investing and how it could be applied to Impact Investing related to Water/Food/Health beyond the financial economy. A Case for discussion was developed.

Then a Vulture Fund entered the scene with the intent to break up the Global Industrial and its Alliances/Relations. Therefore, cooperation between the representative of the Task Force and Bankier.co came to a halt.

An improved HBS.edu NVC-entry - boosted by FINTECH - was submitted January 15, 2024.

It is an alternative to "Vulture-funds" - e.g. to challenge a "2/20-remuneration-formula", which has tended to benefit primarily the General Partners. Through special provision in the law, that 20% is treated not as regular compensation, but as Carried Interest, entitling it to preferential capital gains tax treatment; i.e. General Partners are taxed as companies - and NOT as private individuals. Look to the Page on: "Funds Management".

For further details on the CVN-Approach for Impact Investing in Maritime Regions look the Page: "A Columbus' Egg", where a solution to the Conundrum of effecitive Impact Investing is explained.

Note: For an introduction to initiating- and/or participating in an innovative Collaborative Value Network (CVN)-Approach - for owners/enterprisers and investors in a maritime region - look to the Page: "Networking in Maritime Regions" , hereunder Optional Reading on Endowment for Ethics & Enterprise (EEE) - and the Page: "Contact Bankier.co".